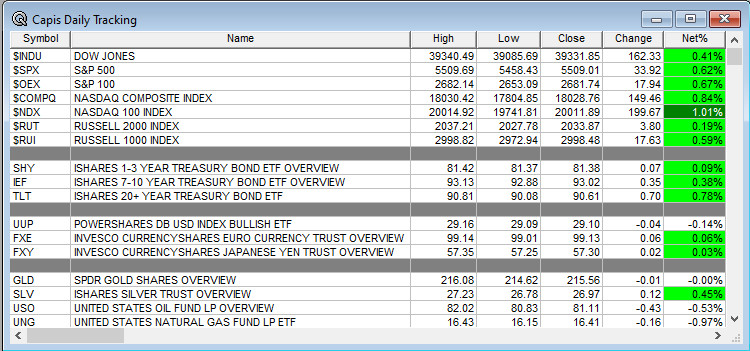

Overnight Summary: The S&P 500 closed Tuesday higher by +0.62% at 5509.01 from Monday higher by 0.27% at 5475.09. The overnight high was hit at 5,572.55 at 4:55 a.m. EDT and the low was hit at 5559.75 at 11:30 a.m. EDT. The overnight range is 13 points. The current price is 5562.75 at 8:45 a.m. EDT lower by -6.75.

- Lots of economic data, check out our Economics Section below.

- Beats: SLP +0.04 of note.

- Flat: None of note.

- Misses: CDMO -0.03 of note.

Capital Raises:

- IPOs For The Week: GLE MJID NAMI PGHL

- New IPOs/SPACs launched/News:

- Magic, an AI startup, valued at $1.5 bln following latest funding round.

- IPOs Filed/Priced:

- Secondaries Filed or Priced:.

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- .

- PIPE:

- Convertible Offering & Notes Filed:

- RPAY to offer $260 mln convertible senior notes due 2029.

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

-

- Biggest Gainers and Losers For The Week Of Note:

- No moves of greater than 2%.

- .

- FFWM announces over $225 million equity investment anchored by Fortress Investment Group, Canyon Partners, Strategic Value Bank Partners, and North Reef Capital.

- SPB files confidential Form 10 registration statement with the SEC for the spin-off of its home and personal care business.

- AAPL to get observer role on OpenAI’s (MSFT) board. (Bloomberg)

- RIVN ticking lower after EV maker denies media report that it’s in talks to extend partnership with Volkswagen beyond their software joint venture.

- SLB and CHX get request from Department of Justice for additional information related to proposed merger.

- LMT awarded $520 mln U.S. Air Force contract modification.

- Biggest Gainers and Losers For The Week Of Note:

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- STN announces that Vito Culmone will join the co in mid-July as next CFO.

- AHCO appoints Dale Wolf as Chairman of the Board, effective July 1

Dividends Announcements or News:

- Stocks Ex Div Today: CMCSA PGR CPB ACM THO CUZ KFY SCS BDN

What’s Happening This Morning: Futures S&P 500 -6.75, NASDAQ 100 -35, Dow Jones -22 Russell 2000 +9.23. Asia and Europe is higher this morning. VIX Futures are at 13.20 from 13.58 yesterday while Bonds at 4.43% from 4.45% yesterday on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower for the third day in a row. Gold, Silver and Copper are higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $60,179 from$62,680 lower by -2.82% this morning.

- Daily Positive Sectors: Consumer Cyclical, Financial, Communication Services and Technology of note.

- Daily Negative Sectors: Healthcare of note.

- One Month Winners: Technology, Real Estate, Healthcare and Communication Services of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and of note.

- Six Month Winners: Communication Services, Technology, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Energy, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare, Energy and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close: of note.

- Friday Before The Open: of note.

Earnings of Note This Morning:

- Beats: STZ $0.10 of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: CVAC +23.4%, DOYU +22.1%, SCLX +16.1%, BHR +7.6% of note.

- Gap Down: FFWM -27.7%, RPAY -20.9%, SLP -8.2%, CIFR -3.7%, CDMO -3.1% of note.

Insider Action: AFG sees Insider buying with dumb short selling. CTRN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before The Market Opens on Wednesday morning. (CNBC)

- Stocks Making the Biggest Moves Pre-Market: . (CNBC)

- Market Wrap: European stocks rise with boost from rate outlook. (Bloomberg)

- Bloomberg Lead Story: Biden Blames Jet Lag For Poor Debte Performance. (Bloomberg)

- Tesla (TSLA) up 3% on better than expected deliveries report. (CNBC)

- AI drive thru ordering is on the rise. (CNBC)

- FDA approves Eli Lilly (LLY) Alzheimer’s drug for early stage. (CNBC)

- President Trump leads President Biden 49% to 43% in CNN Poll. (CNN)

- Skydance to pay $1.75 billion to National Amusements for Paramount (PARA). (WSJ)

Economic:

- June ADP Employment Report is due out at 8:15 a.m. EDT and is expected to rise to 163,000 from 152,000. Equity Markets close at 1:00 p.m. EDT.

- May Factory Orders are due out at 10:00 a.m. EDT and are expected to fall to 0.3% from 0.7%.

- June Non ISM Manufacturing is also due out at 10:00 a.m. EDT and expected to fall to 52.50% from 53.80%.

- Weekly Crude Oil Inventories are due out at 10;30 a.m. EDT.

- Weekly Natural Gas Inventories are due out at 12:00 p.m. EDT,

- Weekly MBA Mortgage Applications came in at -2.60%, out at 7:00 a.m. EDT.

- Challenger Jobs Cuts came in at 48,786 versus 63,816 last month, out at 7:30 a.m. EDT.

Geopolitical:

- Latest FOMC Minutes are due out at 2:00 p.m. EDT.

Federal Reserve Speakers

- Federal Reserve New York President John Williams spoke early this morning at 7:00 a.m. EDT.

M&A Activity and News:

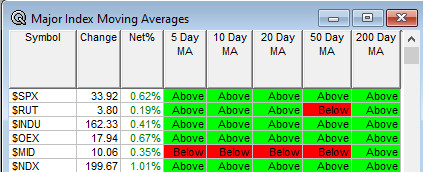

Moving Averages On Major Indexes: Moves from 77% to 83% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: MAMA, VTAK

- Investor/Analyst Day/Calls:

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: PAM FFWM DEO

Downgrades: JDDSF LBRDA CHTR

Initiated: