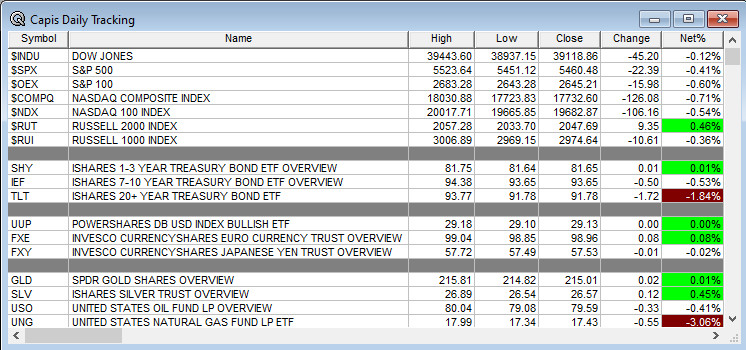

Overnight Summary: The S&P 500 closed Friday lower by -0.41% at 5460.48 from Thursday higher by +0.09% at 5490.81. The overnight high was hit at 5,540.25 at 3:00 a.m. EDT and the low was hit at 5521 at 5:15 a.m. EDT. The overnight range is 19 points. The current price is 5526.25 at 6:00 a.m. EDT higher by +4.75.

- Several economic releases out this morning including ISM Manufacturing and Factory Orders.

- 3 month & 6 month bill auctions at 11:30 a.m. EDT.

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: GLE MJID NAMI PGHL

TBN, WBTN, WOK. - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- OneStream (OS) files registration statement for IPO.

- Secondaries Filed or Priced:

- .

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- RIG files for 55,513,043 shares of common stock by selling shareholders.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- PEPG files $250 millionn mixed shelf securities offering.

- FGEN files a $300 million mixed shelf securities offering.

- VFF files $200 mln mixed shelf securities offering.

- ACHV files $200 mln mixed shelf securities offering.

- GEHC files a mixed-shelf offering.

- KNSA files for $400 mln mixed securities shelf offering.

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers For The Week Of Note:

- CASI (5.46 +49.18%), ALNY (243.28 +46.82%), EGRX (4.97 +20.05%), STAA (47.49 +16.53%) FDX (299.27 +17.98%) RGS (22.96 +362.9%), LIND (9.5 +25.5%), CUK (17.12 +18.61%), TLYS (5.81 +16.2%), CCL (18.6 +15.74%), CVNA (130.45 +15.45%) DAKT (13.81 +28.94%), INFN (6.15 +19.09%), RPD (43.82 +14.95%) FFWM (6.53 +17.45%) NINE (1.68 +17.13%), KLXE (5.14 +15.51%)

- CYRX (6.83 -29.64%), OMI (13.4 -21.07%), ELAN (14.39 -20.3%), BOLD (3.84 -19.5%), PTCT (29.96 -17.96%), INSP (133.87 -17.6%), EVH (18.93 -15.87%), SGMO (0.38 -15.42%) HTZ (3.48 -14.5%) CONN (1.1 -49.77%), NDLS (1.58 -23.91%), NKE (75.12 -22.7%) SEDG (25.03 -24.19%), DQ (14.52 -18.65%), CMTL (3.13 -14.15%) STI (0.43 -19.11%), RILY (17.46 -14.79%) NUS (10.64 -14.51%)

- Multiple banks increased dividends following release of Fed Stress Test on Banks.

- RF passed minimum capital levels under the Fed Stress Test.

- SAN passed minimum capital levels under the Fed Stress Test.

- MTB updates Fed Stress Test and awaits a final update on its capital levels.

- MA rejects class action settlement with merchants.

- LMT awarded a $5.28 bln US Army contract for Phased Array Tracking Radar.

Buybacks or Repurchases:

- TFC increases buyback by $5 billion post Fed Stress Test.

- JPM increases buyback by $30 billion post Fed Stress Test.

- CFG increases capacity of repurchase plan by $656 mln to $1.25 bln.

Exchange/Listing/Company Reorg and Personnel News:

- NSA discloses in SEC filing that Derek Bergeon, the company’s executive vice president and chief operating officer, have mutually agreed to terminate his employment with the company.

- MCW COO Mayra Chimienti resigns but will provide transition services into year end.

Dividends Announcements or News:

- Stocks Ex Div Today: APD PWR RJF CAH STT EHC INGR CMC CHH ANDE RITM

- BAC increases quarterly dividend by 8% to $0.26.

- MS increases quarterly dividend by 9% to $0.925.

- STT increases quarterly dividend by 10% to $0.77.

- BK increases quarterly dividend by 12% to $0.47

- FITB increases quarterly dividend by 0.02 in September.

- STT increases quarterly dividend by 10% to $0.77.

- PNC increases quarterly dividend by 3% to $1.60.

- JPM increases quarterly dividend by 9% to $1.25.

- WFC increases quarterly dividend by 14% to $0.40.

- GS increases quarterly dividend by $3.00 from $2.75.

- C increases quarterly dividend by 6% to $0.56.

What’s Happening This Morning: Futures S&P 500 +, NASDAQ 100 +, Dow Jones +, Russell 2000 +. Asia is higher ex Australia while Europe is higher this morning ex France. VIX Futures are at +13.89 from +13.85 Friday while Bonds at 4.412% from 4.308% Friday on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold and Silver are lower with Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and higher against the Yen. Bitcoin is at $62,871 from $61,482 higher by 1.53% this morning.

- Daily Positive Sectors: Real Estate, Financials, Energy and Materials of note.

- Daily Negative Sectors: Communication Services, Utilities, Consumer Cyclicals and Consumer Defensive of note.

- One Month Winners: Technology, Real Estate, Healthcare and Communication Services of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and

Healthcareof note. - Six Month Winners: Communication Services, Technology,

Industrials, Healthcare and Financials of note. - Twelve Month Winners: Communication Services, Technology, Financials, Energy, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare, Energy and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close: None of note.

- Tuesday Before The Open: MSM RDUS of note.

Earnings of Note This Morning:

- Beats: None of note.

- Flat: None of note.

- Misses: None of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: CHWY +18.9%, MESO +13.4%, BW +12.4%, NIO +6.2%, SPR +5.7%, SWTX +5.5%, LI +4.2%, ZK +4.1%, VALN +4.1%, HUT +3.4%, NSA +3.1%, NOAH +2.4%, ALVO +2.3%, CDLR +2.2% of note.

- Gap Down: ACHV -4.3%, SBS -1.5%, BA -1.3%, VFF -1% of note.

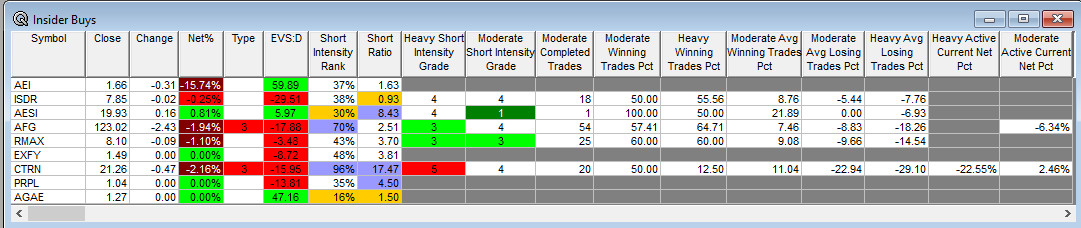

Insider Action: AFG sees Insider buying with dumb short selling. CTRN sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Friday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves Pre-Market: GMW CHWY VZ ICE. (CNBC)

- Morning Briefing For Bloomberg Subscribers. (Bloomberg)

- Bloomberg Lead Story: Macron and The French Left Race to Stop Right Movement. (Bloomberg)

- Barron’s is + on AAPL GOOGL IRTC DXCM ABT CPB YELP SMPL CVLT EEFT GMS POWL XOM CTRA EOF OXY and +/- on NVDA

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today.

- President Biden at Camp David until 8:20 p.m. EDT when he returns to the White House.

Economic:

- June ISM Manufacturing Index is due out at 10:00 a.m. EDT and expected to improve to 49.1% from 48.70.

- May Construction Spending is due out at the same time and expected to improve to 0.1% from -0.1%.

Federal Reserve Speakers

- Federal Reserve New York President John Williams speaks at 9:00 a.m. EDT.

M&A Activity and News:

- Blackrock (BLK) buys Preqin for $3.2 billion. (Bloomberg)

- Boeing (BA) to buy Spirit AeroSystems (SPR) for $4.7 billion. (CNBC)

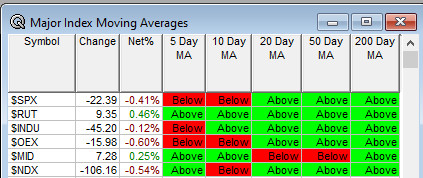

Moving Averages On Major Indexes: Moves from 67% to 73% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Fireside Chat: None of note.

- Top Shareholder Meetings: GODN, GVP, PEGY, TGAA

- Investor/Analyst Day/Calls: None of note. TRTL, TSLA

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation: ARCT

- Company Event:

- Industry Meetings:

- Capital Link Decarbonization in Shipping Forum

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: ICE BIRK

Downgrades: ICFI