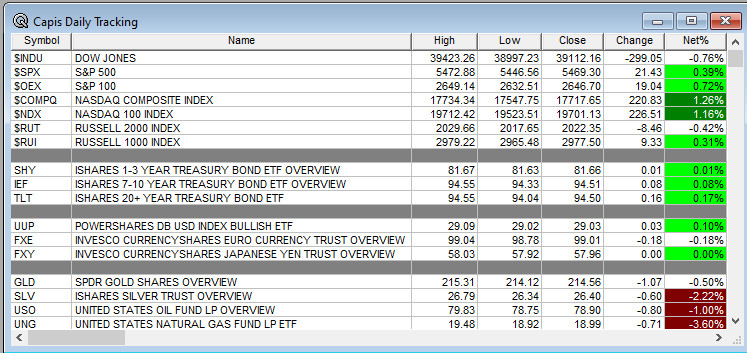

Overnight Summary: The S&P 500 closed Tuesday higher by +0.39% at 5469.30 from Monday lower by -0.31% at 5447.87. The overnight high was hit at 5,551.75 at 4:50 a.m. EDT and the low was hit at 5533.50 at 6:05 p.m. EDT. The overnight range is 18 points for a second day. The current price is 5539 at 6:40 a.m. EDT higher by +2.00.

- 5-Year Auction at 1:00 p.m. EDT.

- New Homes Sales are out at 10:00 a.m. EDT.

- Beats: PRGS +0.14, FDX +0.07 of note.

- Flat: of note.

- Misses: WOR -0.14 of note.

Capital Raises:

- IPOs For The Week: ACTU, GLE, LB, MJID, NVA, OSTX, QMMM

TBN, WBTN, WOK. - New IPOs/SPACs launched/News:

- IPOs Filed/Priced:.

- Secondaries Filed or Priced:

- GTI files for 12,028,075 shares of common stock.

- TXO commences public offering of 5,000,000 common units

- MULN up to 75 million shares.

- Notes Priced of note:

- CHH Senior Notes priced.

- NYMT Senior Notes priced.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- GTI files for 108,848,493 shares of common stock by selling shareholders; relates to warrants.

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- PIPE:

- Convertible Offering & Notes Filed:

- .

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close Of Note:

- RIVN +49%, FDX +14%, TGLS +13%, LCID +12%, GTI +4%.

- ALLK -16.10%, WOR -9.3%, TXO -9%.

- FedEx beats on deep cost cuts. (Bloomberg)

- Stock buyback blackout period could see stocks pullback. (MarketWatch)

- Volkswagen will invest $1 billion in Rivian (RIVN) and up to $5 billion. (NYT)

- Greenlight Capital sues former employee in a riveting read. (Bloomberg)

- CACI announces that it won an eight-year contract valued at up to $2 billion to provide digital solutions technology to standardize and centralize 11 of NASA’s IT services.

- KKR acquires a portfolio of 18 multifamily assets from a closed-ended fund sponsored by Quarterra Multifamily for about $2.1 billion.

- DASH held talks to take over Deliveroo but ended after valuation disagreement. (Reuters)

Buybacks or Repurchases:

- None of note.

Exchange/Listing/Company Reorg and Personnel News:

- CPNG appoints Asha Sharma to its Board; serves as Corporate Vice President and Head of Product, AI Platform at Microsoft (MSFT)

- MEI appoints Jon DeGaynor as President and CEO, effective July 15

- AI appoints Merel Witteveen as Interim COO, effective immediately.

Dividends Announcements or News:

- Stocks Ex Div Today: ZBH PSEC MERC FLXS

What’s Happening This Morning: Futures S&P 500 -3.75, NASDAQ 100 +10, Dow Jones -86, Russell 2000 -7.85. Asia is higher ex Australia while Europe is higher this morning ex France. VIX Futures are at 14.10 from 14.33 yesterday while Bonds at 4.283% from 4.226% yesterday on the 10-Year. Crude Oil and Brent are higher while Natural Gas is lower. Gold, Silver and Copper are lower. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $61,392 from $61,409 lower by -0.88% this morning.

- Daily Positive Sectors: Communication Services and Technology of note.

- Daily Negative Sectors: Real Estate, Materials and Industrials of note.

- One Month Winners: Technology, Healthcare and Communication Services of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and Healthcare of note.

- Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Consumer Cyclical of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare and Consumer Defensive of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Wednesday After the Close:

- Thursday Before The Open:

Earnings of Note This Morning:

- Beats: GIS +0.02 of note.

- Flat: of note.

- Misses: of note.

- Still to Report: PAYX UNF of note.

Company Earnings Guidance:

- Positive Guidance: of note.

- Negative Guidance: of note.

Erlanger Research Advance/Decline Chart: Remains awful for NASDAQ and weak for NYSE.

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: RIVN +38.5%, FDX +14.4%, SVRA +11.6%, VSTO +10.8%, LCID +8.4%, TGLS +7.8%, ANNX +6.6%, GTI +5.5%, PL +4.8%, FUN +3.5%, ENTG +2.3%, ARGX +2.1%, KNSA +2% of note.

- Gap Down: TSHA -16%, ALLK -11%, GLT -9.9%, LUV -9%, TXO -7.7%, WOR -7.5%, RMBL -3.6% of note.

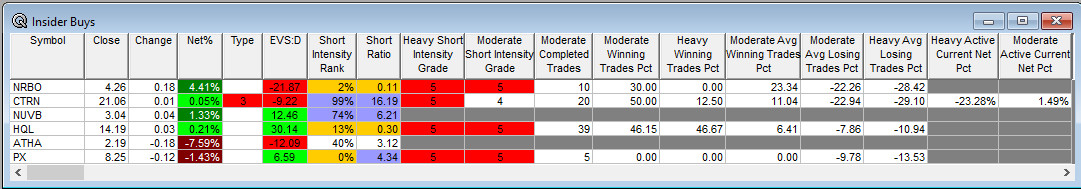

Insider Action: None of note saw Insider buying with dumb short selling. CTRN saw Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Wednesday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Stocks Making the Biggest Moves Pre-Market: NVDA FDX RIVN MU. (CNBC)

- Market Wrap: U.S. futures waver as Fed official cools rate hopes. (Bloomberg)

- Bloomberg Lead Story: Yen Tumble to Worst Level Since 1986 Boosts Risk of Intervention. (Bloomberg)

- Weekly Mortgage Applications came in at +0.8% from +0.9% a week ago.

- Southwest Airlines (LUV) cuts guidance. (CNBC)

- Barron’s is positive on retailers this morning including GPS, AEO, URBN, TPR, FL. (Barron’s)

- Barron’s out positive on McDonalds (MCD). (Barron’s)

- Bloomberg: The Big Take: The Bill Hwang Tapes and Chats: How 72 Hours Destroyed Archegos. (Podcast)

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today.

- President Biden is still at Camp David preparing for his debate with Donald Trump on Thursday.

Economic:

- May New Home Sales is due out at 10:00 a.m. EDT and is expected to rise to 650,000 from 634,000..

- Weekly EIA Crude Oil Inventories are due out at 10:30 a.m. EDT.

Federal Reserve Speakers

- None of note. It’s a miracle. Quiet is nice.

M&A Activity and News:

- None of note.

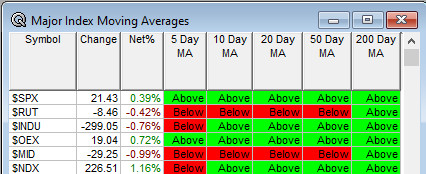

Moving Averages On Major Indexes: Moves from 73% to 80% of the moving averages now positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Citi Annual Brazil Equity Conference

- Morgan Stanley Life Sciences AI Conference

- Oppenheimer Life Sciences Summit

- Stifel European Healthcare Summit

- Truist Healthcare Disruptors & Digital Health Summit

- Top Shareholder Meetings: AFMD, AUID, HOOD, INFY, NVDA, QFIN, TAK, UTHR, VALN, ZGN

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ALT, BIVI, EYPT, FGEN, GRND, MCD, MFC, PLX, RYAM, TDG

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- DASH Summit

- John Tumazos Very Independent Research Conference.

- Spinal Cord Injury Investor Symposium

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades:

Upgrades: TGLS RGEN PAGS HD AAPL

Downgrades: APTV