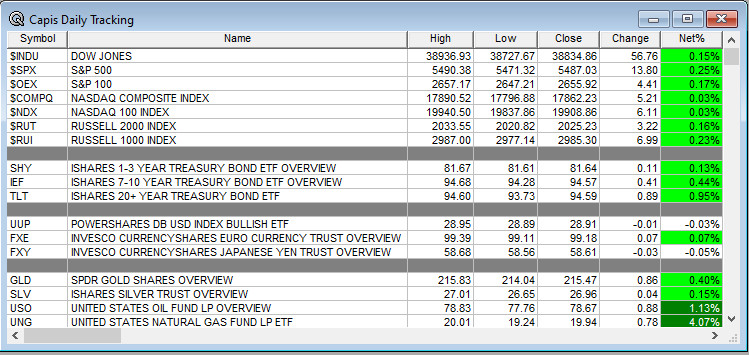

Overnight Summary: The S&P 500 closed Tuesday higher by 0.25% at 5487.03 from Monday higher by 0.77% at 5473.23. The overnight high was hit at 5,588 at 3:35 a.m. EDT and the low was hit at 5557.50 at 4:05 p.m. EDT on Tuesday. The overnight range is 31 points. The current price is 5583 at 6:25 a.m. EDT higher by +23.25.

- Several economic releases of note including Housing Starts and Philadelphia Fed Manufacturing Index.

- Treasury Auction of 5-year TIPS Auction at 1:00 p.m. EDT.

- Several Federal Reserve Speakers as well.

- Beats: KBH +0.35 of note.

- Flat: None of note.

- Misses: None of note.

Capital Raises:

- IPOs For The Week: EHGO KAPA MJID NVA OSTX QMMM

- New IPOs/SPACs launched/News:

- Luxury sneaker maker Golden Goose Group is postponing its IPO as luxury stock valuations soften

- IPOs Filed/Priced:.

- Secondaries Filed or Priced:

- ARBE files for 11,542,497 shares of common stock.

- Notes Priced of note:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- FBLG files for 16,022,644 shares of common stock by selling shareholder.

- IPSC files for 7,868,666 shares of common stock by selling shareholders

- Debt/Credit Filing and Notes:

- IPSC

- PIPE:

- Convertible Offering & Notes Filed:

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- Biggest Gainers and Losers After The Close:

- IPSC +4.7%, FBLG +3.1%, CRSR +2.4%, KBH +2.3%, .

- DJT -10.6%, HMST -2.5%.

- AMD ticking slightly lower as AMD investigates claims from cybercriminal hacker that it stole information in a hack. (Bloomberg)

- BA awarded $212 million U.S. Navy contract under previously awarded basic ordering agreement.

Buybacks or Repurchases:

- .

Exchange/Listing/Company Reorg and Personnel News:

- WDFC non-executive chair Gregory A. Sandfort to retire, effective December 12; Eric P. Etchart named successor.

- TREE promotes Jason Bengel to CFO, following departure of Trent Ziegler, effective Aug 9; co raises Q2 revenue guidance.

Dividends Announcements or News:

- Stocks Ex Div Today: STX BBY UWMC SNV ASO KLIC LTC.

What’s Happening This Morning: Futures S&P 500 +27, NASDAQ 100 +142, Dow Jones +60, Russell 2000 +6. Asia is higher ex Australia while Europe is higher this morning. VIX Futures are at 14.16 from 14.34 Tuesday while Bonds at 4.254% from 4.248% Tuesday on the 10-Year. Crude Oil and Brent are higher while Natural Gas is lower. Gold, Silver and Copper are higher today. The U.S. Dollar is higher versus the Euro, higher versus the Pound and higher against the Yen. Bitcoin is at $65,718 from $65,795 higher by +1.36% this morning.

- Daily Positive Sectors: Energy, Technology, Financials, Industrials, Consumer Defensive and Financials of note.

- Daily Negative Sectors: Communication Services, Consumer Cyclicals and Healthcare of note.

- One Month Winners: Technology, Healthcare, Communication Services, Consumer Defensive and Real Estate of note.

- Three Month Winners: Communication Services, Utilities, Technology, Consumer Defensive and Healthcare of note.

- Six Month Winners: Communication Services, Technology, Industrials, Healthcare and Financials of note.

- Twelve Month Winners: Communication Services, Technology, Financials, Industrials, and Healthcare of note.

- Year to Date Winners: Communication Services, Technology, Financials, Healthcare and Utilities of note.

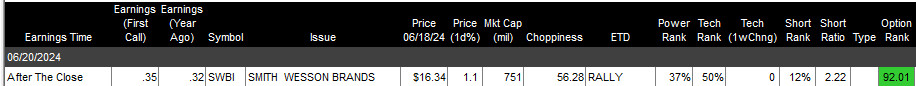

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Thursday After the Close: None of note.

- Friday Before The Open:

Earnings of Note This Morning:

- Beats: KR +0.08 SCS +0.06, DRI +0.04, JBL +0.04 of note.

- Flat: None of note.

- Misses: ACN -0.03, GMS -0.12 WGO -0.18 of note.

- Still to Report: CMC of note.

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative Guidance: None of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+4% or down more than -4%):

- Gap Up: TPST +48.8%, VUZI +9.8%, VZLA +5.1%, DELL +3%, FBLG +2.4%, TREE +2.3%, ACN +2.3%, KBH +2% of note.

- Gap Down: HAE -8.6%, DJT -7.2%, VNDA -5.4%, GMS -5.4%, OPT -3.2%, ARBE -3% of note.

Insider Action: CM sees Insider buying with dumb short selling. No stocks see Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Now Before The Market Opens on Thursday morning. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Market Wrap: Global stocks advance as rate cut momentum builds. (Bloomberg)

- Bloomberg Lead Story: . (Bloomberg)

- Bank of England holds rates steady even though inflation hits 2% level. (CNBC)

- Chinese President Xi’s mystery PBOC plans surface with biggest shift in years. (Bloomberg)

- Darden (DRI) beats on earnings even though Olive Garden disappoints. (CNBC)

- Mortgage Demand flattens even though rates hits lowest levels. (CNBC)

- Car Dealerships halt operations after cyber attack. (Bloomberg)

- Bloomberg: The Big Take: What happens inside Hedge Fund Boot Camps. (Podcast)

- Marketplace: 2014 The Year that shaped social media. (Podcast)

- President Biden’s Daily Schedule:

- There is a Daily Briefing scheduled for 10:00 a.m. EDT today.

- President Biden spends the day at the beach in Delaware and then heads to Camp David on Thursday night.

Economic:

- June Philadelphia Fed Index is due out 8:30 a.m. EDT and is expected to rise to 6.5 from 4.5.

- May Housing Starts are due out at 8:30 a.m. EDT and are expected to rise to 1,385,000 from 1,360,000.

- Weekly Jobless Claims are due out at 8:30 a.m. EDT.

- Weekly Petroleum Report is due out at 11:00 a.m. EDT.

Federal Reserve Speakers

- Federal Reserve Minneapolis President Neel Kashkari speaks at 8:45 a.m. EDT.

- Federal Reserve Richmond President Thomas Barkin speaks at 3:00 p.m. EDT.

- Federal Reserve San Francisco President Mary Daly speaks at 7:15 p.m. PDT.

M&A Activity and News:

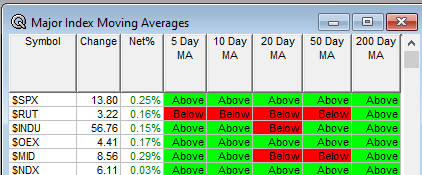

Moving Averages On Major Indexes: 77% from 70% of the moving averages are positive.

Meeting & Conferences of Note:

- Sellside Conferences:

- Citi European Healthcare Conference

- Citizens JMP Medical Devices and Healthcare Services Forum

- Scotiabank Healthcare 1X1 Day

- TD Cowen Genetic Medicines & RNA Summit

- Top Shareholder Meetings: BJ, BTG, BUR, CAVA, CRON, DASH, DLTR, GRIN, HTGC, IVA, MNSO, MRVL, OEC,

OLED, PATH, SJW - Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ALDX, CUTR, GRRR, IINN, MGRM, NVRI, ORA, PSTG

- Update: None of note.

- R&D Day: None of note.

- FDA Presentation:

- Company Event:

- Industry Meetings:

- GCFF Bio Investing Conference

- iFX Expo

- IMS 2024

- Intersolar Europe

- Next-Gen-Immuno-Oncology Conference

- Singular Research’s Summer Solstice Conference

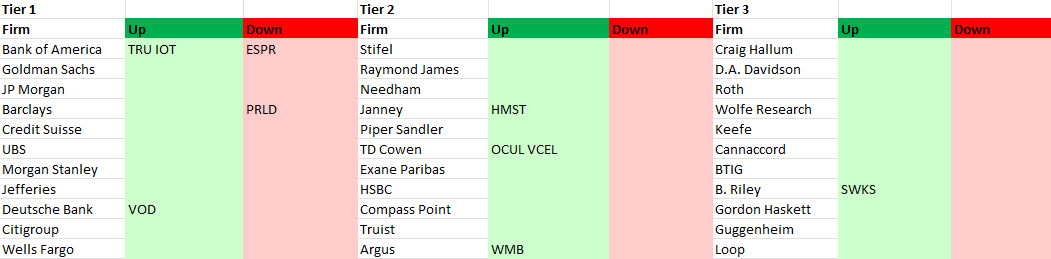

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: