Overnight Summary: The SP 500 closed Tuesday higher by 1.20% at 5070.55 from Monday higher by 0.87% at 5010.60. The overnight high was hit at 5,128.75 at 1:55 a.m. while the overnight low was hit at 5103.50 at 4:05 p.m. EDT. The range overnight is 25 points as of 7:05 a.m. EDT. Currently, the S&P 500 is higher by +11.75 points at 8:07 a.m. EDT.

- Beats: WIRE +0.27, EQT +0.17, MANH +0.16, STLD +0.16, MTDR +0.15, CB +0.10, RRC +0.10, MAT +0.10, V +0.07, STX +0.04, TXN +0.03, WSBC +0.01 of note.

- Flat: None of note.

- Misses: ENPH -0.06, VICR -0.04, TSLA -0.04, HA -0.03, VBTX -0.02, EGP -0.02, APAM -0.01 of note.

Capital Raises:

- IPOs Priced or News:

- New SPACs launched/News:

- Secondaries Priced:

- Notes Priced of note:

- Common Stock filings/Notes:

- CNTA files $100 million offering of ADRs

- FLGC files 2,135,199 share of common stock

- MGRX files 30,014,286 shares of common stock

- MOVE files 36,594,656 share of common stock with another 39,015,499 shares of common stock underlying warrants 2,420,843 of common stock underlying pre-funded warrants.

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- BDSX files 30,434, 280 shares of common stock by selling shareholders

- Private Placement of Public Entity (PIPE):

- Mixed Shelf Offerings:

- LUXH file $50M mixed-shelf offering

- MPU files $3.29M mixed-shelf offering

- ZTEK files $50 M mixed-shelf offering

- Debt/Credit Filing and Notes:

- Tender Offer:

- Convertible Offering & Notes Filed:

Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

News After The Close :

- After Hours Movers:

- TSLA +9.9%, TXN +6.5%, LRN +6.1%, CSGP +3.2%, V +2.7%, STLD +2.3%

- VICR -9.6%, MANH -7%, ENPH -6.1%, VBTX -3%, TCMD +2.6%

- News Items After the Close:

- Tesla (TSLA) states 2024 growth rate will be less than 2023. Yet stock is rewarded as cheaper car promised in 2025. (CNBC)

- Lumen Technologies (LUMN) to cut workforce by 7%.

- Cleveland Cliffs (CLF) CEO was interviewed on CNBC after the close.

- Exchange/Listing/Company Reorg and Personnel News:

- Buyback Announcements or News:

- Stock Splits or News:

- Dividends Announcements or News:

- OTIS ups dividend to $0.39 from $0.34.

- MET ups dividend to $0.545 from $0.52 a share.

- AMAL ups dividend to $0.12 from $0.10 a share.

What’s Happening This Morning: Futures value reflects the change with fair value.

Sector Action – (1/3/6/12/YTD Updated Weekly with Monday release):

- Daily Positive Sectors: All ex Materials were positive led by Technology, Communication Services, Healthcare and Industrials of note.

- Daily Negative Sectors: Materials of note.

- One Month Winners: Energy and Utilities of note.

- Three Month Winners: Energy, Basic Materials, Industrials, and Financial of note.

- Six Month Winners: Financials, Industrials, Technology and Communication Services of note.

- Twelve Month Winners: Communication Services, Technology, Industrials, and Financial of note.

- Year to Date Winners: Communication Services, Energy, Financials, Industrials, and Technology of note.

Technology shares led stock indexes higher Tuesday ahead of a spate of major earnings reports. The tech-heavy Nasdaq Composite jumped 1.6%, extending its rebound from a recent selloff to a second consecutive day. The S&P 500 rose 1.2%, and the Dow Jones Industrial Average was 0.7% higher, or about 264 points. Investors were encouraged by strong earnings reports before the opening bell from General Motors, United Parcel Service and GE Aerospace, which reported earnings as a stand-alone company for the first time since separating from General Electric’s power business. (WSJ – Edited by QPI)

Upcoming Earnings Of Note:

- Wednesday After the Close:

- Thursday Before the Open:

Earnings of Note This Morning:

- Beats: HUM +1.11, COOP +0.68, OC +0.52, BG +0.51, BA +0.50, WAB +0.40, TMO +0.40, HAS +0.34, LII +0.31, RCI +0.27, BIIB +0.22, VIRT +0.21, HELE +0.15, AVY +0.14, HLT +0.12, TNL +0.11, GPI +0.11, PRG +0.09, VRT +0.07, SLAB +0.06, MAS +0.05, CME +0.05, BSX +0.05, TEL +0.03, SFL +0.03, OTIS +0.01, IPG +0.01 and T +0.01% of note.

- Flat: EVR, ODFL of note.

- Misses: LAD -1.74, ETR -0.35, SYF -0.16, CSTM -0.13, NAVI -0.12, EDU -0.10, TDY -0.08, WNC -0.06, GD -0.03 of note.

- Still to Report: None of note.

Company Earnings Guidance:

- Positive Guidance: MANH, LRN, BSX and WAB of note.

- Negative Guidance: ENPH, HELE, HLT, TEL and TDY of note.

Erlanger Research Advance/Decline Chart:

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: VRT +16.2%, TSLA +11.5%, AFMD +7.3%, TXN +7.3%, LRN +6.5%, MCFT +5%, VIRT +5%, TVTX +4.9%, TRMK +4.9%, WFRD +4.1%, NTB +3.8%, TTEC +3.7%, TMO +3.6%, CSGP +3%, VLTO +2.9%, V +2.9%, MAT +2.8%, EWBC +2.8%, STLD +2.5%, HLT +2.5%, EARN +2.2% of note.

- Gap Down: HIW -24.4%, ENPH -10.3%, VICR -8.6%, MANH -7.2%, LAD -5.5%, MMC -5%, SEDG -3.8%, EDU -3.5%, BKR -3.3%, VBTX -3%, ORAN -2.1%, KMPR -2% of note.

Insider Action: No stock see Insider buying with dumb short selling. LOVE sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- 5 Things To Know Before the Stock Market Opens Today. (CNBC)

- What You Need To Know To Start Your Day. (Bloomberg)

- Bloomberg Lead Story: Biden’s Gains Vanish Against Trump On Deep Economic Pessimism. (Bloomberg)

- Tech Rally keeps stocks afloat amid mixed earning: Markets Wrap. (Bloomberg)

- Senate passes Ukraine Aid, shipments to begin within days. (Bloomberg)

- Secretary of State Blinken lands in China to begin a round of talks on U.S. sanctions. (Bloomberg)

- JP Morgan CEO Jamie Dimon says U.S. economy is “booming” but cautious on “soft landing”. (FT)

- Mortgage Demand drops as interest rates soar over 7%. (CNBC)

- Oracle (ORCL) to move headquarters to Nashville as seeks to expand healthcare business. (WSJ)

- Amazon (AMZN) seeks to open some cloud regions in Southwest Asia. (CNBC)

- Bloomberg: Daybreak Podcast: (Podcast)

- Bloomberg: The Big Take: Bolstered by billions, Qatar plays mediator. (Podcast)

- Marketplace: Training for the next crisis with serious games. (Podcast)

- NY Times Daily: Is $60 Billion enough to save Ukraine? (Podcast)

- Wealthion: Fast track wealth building. (Podcast)

- Adam Taggart’s Thoughtful Money: Why did stocks just fall 5%? (Podcast)

Moving Average Update: Score improves to 51% from 31%.

Geopolitical:

- President’s Public Schedule:

- The President receives the President’s Daily Brief, 10:00 a.m. EDT

- The President delivers political remarks at North America’s Building Trade Union National Legislative Conference, 12:30 p.m. EDT

- The President arrives at the White House, 1:20 p.m. EDT

- Press Briefing by Press Secretary Karine Jean-Pierre, 1:30 p.m. EDT

Economic:

- March Durable Orders are due out at 8:30 a.m. EDT and are expected to rise to 1.80% from 1.40%

- Weekly Mortgage Applications fell -2.7% week over week.

- The latest NYSE and NASDAQ Short Interest for the period of March 26th through April 11th is due out after the close and during this collection period the S&P 500 fell -0.09%. Since the 11th, it has fallen -4.46%.

Federal Reserve / Treasury Speakers:

- No Fed Speakers as in Blackout Period due to next week’s FOMC meeting.

M&A Activity and News:

- Marsh McLennan (MMC) to buy Fisher Brown Bottrell from Trustmark (TRMK) for $345 million in cash.

Meeting & Conferences of Note:

- Sellside Conferences:

- None of note.

- Top Shareholder Meetings: AN, AMP, ASR, BAC, BALL, BWA, CI, CP, CVGW, ELSE, ETN, GS, GWW, MPC, NEM, PNC, TGNA, TXT

- Fireside Chat: None of note.

- Investor/Analyst Day/Calls: ACRV, EVOK, EXLS, NVX

- Update: None of note.

- R&D Day: None of note.

- Company Event:

- Industry Meetings:

- Alzheimer’s & Parkinson’s Drug Development Summit

- AI Event

- Cambridge Healthtech Institute Immuno-Oncology

- Li-ion Battery Americas

- Spinal Cord Injury Investor Symposium

- The Future of Protein Production

- World Congress Experience

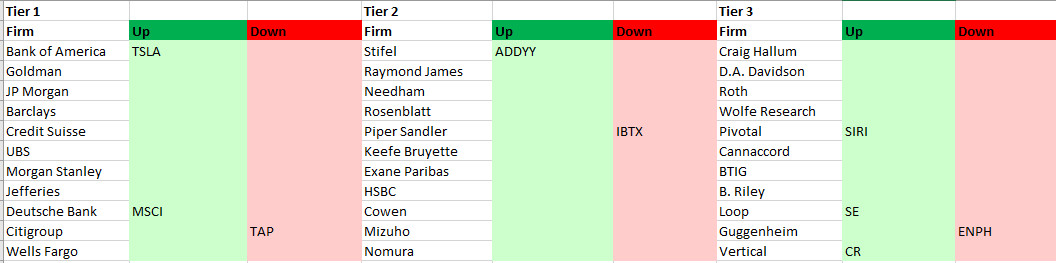

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Today’s Upgrades and Downgrades: