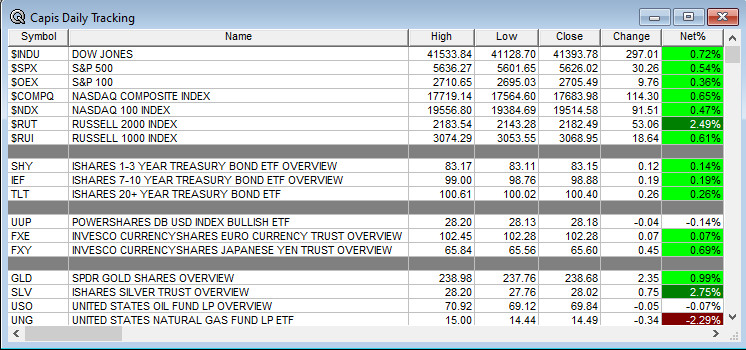

Overnight Summary: The S&P 500 closed Friday higher by 0.54% at 5626.02 from Thursday higher by 0.75% at 5595.76. The overnight high was hit at 5699.25 at 5:15 a.m. EDT and the low was hit at 5683 at 6:25 p.m. EDT. The overnight range is 16 points. The current price is 5690.25 at 6:50 a.m. EDT lower by -0.50 points.

Most Important Article Of the Morning: The Fed Should Go Big Now. I Think It Will. By Bill Dudley Former NY Fed President.

Executive Summary: Stocks are mixed this morning as the S&P 500 comes off last week being up every day.

- 3 & 6 Month Treasury Bill Auction at 11:30 a.m. EDT.

Earnings Out After The Close:

- Beats: None of note.

- Flat:

- Misses: None of note.

- IPOs For The Week:

- New IPOs/SPACs launched/News:

- IPOs Filed/Priced:

- Secondaries Filed or Priced:

- TPG files for 53,004,985 shares of Class A common stock offering

- APLD files for offering of 6,300,449 shares of common stock underlying the warrant issued to a single institutional investor

- DTI files for $250 mln common stock offering

- ADGM: Filed Form S-1 .. Up to 12,036,988 Shares of Common Stock

- HUBC: FORM F-1 – PRIMARY OFFERING OF 1,891,847 ORDINARY SHARES

- LASE: Form S-1.. Up to 3,000,000 Shares of Common Stock

- WAVE: Form F-3.. Up to 1,831,286 American Depositary Shares Representing 14,650,288 Common

Shares

- Notes Priced:

- Direct Offering:

- Exchangeable Subordinate Voting Shares:

- Selling Shareholders of note:

- WSBC files for 7,272,728 share common stock offering by selling shareholders

- BE files for 23,491,701 share common stock offering by selling shareholders

- PAVS files 60,000,000 shares offered by selling shareholders

- Debt/Credit Filing and Notes:

- Mixed Shelf Offerings:

- BE also filed a mixed securities shelf offering (see above on selling shareholders)

- PLL files for $500 mln mixed securities shelf offering

- MANU files for $400 mln mixed securities shelf offering

- LSEA files for $250 mln mixed securities shelf offering

- LQR files for up to $100,000,000 mixed shelf offering

- PIPE:

- Convertible Offering & Notes Filed:

- UPST Proposed Private Offering of $300,000,000 of Convertible Senior Notes Due 2029

- Capital Raise Summary From The TradeXchange, bringing traders and investors real time news and Squawk Box, and other sources.

Biggest Movers Up & Down Last Week:

- Movers Up: CDE (7.28 +37.78%), AG (6.13 +32.29%), HL (6.84 +25.41%), MAG (14.55 +23.79%), KRNT (22.98 +28.45%), PLCE (14.75 +190.26%), SNBR (18.74 +33.57%), RH (319.93 +28.96%), FNKO (11.77 +22.48%), NTGR (21.91 +39.02%), COMM (5.28 +29.61%), AAOI (14.58 +23.41%)

- Movers Down: HUM (321.99 -10.02%), IONS (42.19 -10.02%), APLS (37.5 -8.65%), PEN (188.25 -7.6%), MEOH (37.69 -11.21%), NX (27.54 -9.08%), CAL (31.43 -19.02%), GME (20.57 -14.03%), ALLY (32.72 -17.3%), ARI (9.52 -7.57%), KLXE (5.02 -19.29%), GPRE (12.67 -8.39%), PPC (40.27 -11.04%).

News After The Close :

-

- Deckers (DECK) approves a 6-1 stock split.

- Eli Lily (LLY) gets FDA approves EBGLYSS for adults and children 12 years and older with atopic dermatitis

- NR completes sale of its equity interests in substantially all of the company’s Fluids Systems segment to SCF Partners, Inc for base sales price of $127.5 mln

- DFS reports monthly credit card charge-off and delinquency statistics with no changes of note.

- LHX wins US Navy contract with AAR Government with value of $1.194 billion.

- Saudi Arabia saw its credit outlook revised to positive on sustained reform momentum by a major credit agency.

- Barron’s + on PLTR SLB, LULU, ORCL and the lead story is on America’s Housing Crisis.

- President Trump safe after a second assassination attempt on Sunday at 2:00 p.m. EDT at West Palm Beach Golf Club, suspect in custody. (Reuters)

- 10-Q or 10-K Delays – ALOT of note.

- NASDAQ Delisting Notice – None of note.

Buybacks or Repurchases: Buybacks should be slow as most companies are in a blackout period as earnings season kicks into gear.

- HOLX announces $1.5 bln share repurchase authorization

Exchange/Listing/Company Reorg and Personnel News:

- SNAP announces that Jim Lanzone, CEO of Yahoo Inc., has been appointed to its Board of Directors, effective as of September 12, 2024

Dividends Announcements or News:

- Stocks Ex Div Today: META UNH MRK PLD HCA ICE MO AIG ARES HES EXR AME IRM DTE EDR PKG EG FNF CRBG EMN OLED KBR HLNE DTM PARA MTH RRR NEU PECO UGI FG HOG RYN WU

- Stocks Ex Div Tomorrow: LRCX APH ECL VRT PHM CINF HBAN BSY EXP JJSF ATAT GDEN

What’s Happening This Morning: Futures S&P 500 -3.75 NASDAQ 100 -81 Dow Jones +102 Russell 2000 +12.91. Asia is higher ex Japan with Europe is lower this morning. VIX Futures are at 18.17 from 18.07 Friday while Bonds are at 3.63% from 3.659% on the 10-Year. Crude Oil and Brent are higher with Natural Gas lower. Gold lower with Silver and Copper higher. The U.S. Dollar is lower versus the Euro, lower versus the Pound and lower against the Yen. Bitcoin is at $58,747 from $57,881 lower by -1.92% this morning.

- Daily Positive Sectors: Utilties, Communication Services, Materials, Industrials and Real Estate of note.

- Daily Negative Sectors: None of note.

- One Month Winners: Financials, Healthcare, Consumer Defensive, Real Estate, Consumer Cyclicals and Utilities of note.

- Three Month Winners: Real Estate, Utilities, Financials, Consumer Defensive, Healthcare of note.

- Six Month Winners: Utilities, Consumer Defensive, Real Estate, Financials and Communication Services of note.

- Twelve Month Winners: Technology, Communication Services, Financials, Utilities, Consumer Defensive and Healthcare note.

- Year to Date Winners: Technology, Communication Services, Utilities, Financials, Consumer Defensive and Healthcare of note.

Upcoming Earnings Of Note: (From Chartroom Software – sorted by market cap, highest to lowest with most visible names)

- Monday After the Close: None of note

- Tuesday Before The Open: None of note

Earnings of Note This Morning:

- Beats: None of note.

- Flat:

- Misses: None of note.

- Still to Report:

Company Earnings Guidance:

- Positive Guidance: None of note.

- Negative or Mixed Guidance: None of note.

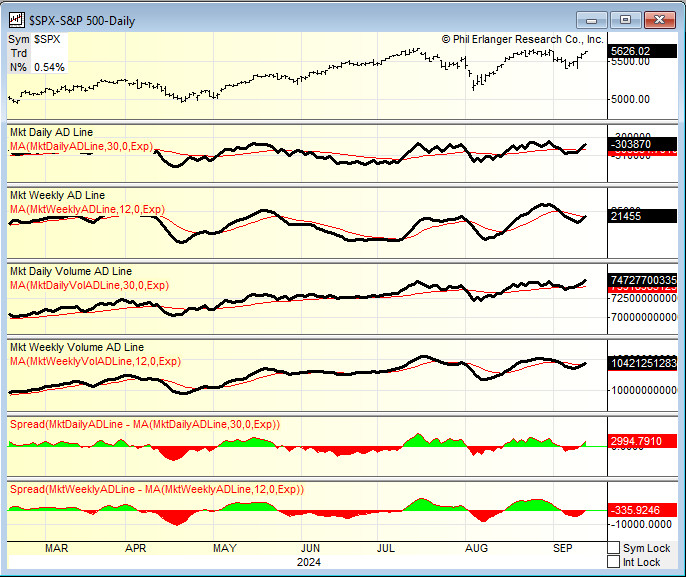

Advance/Decline Weekly Update With Both Daily and Weekly Stats: Markets finally got follow-through last week.

Gap Ups & Down In Early Pre-Market (+2% or down more than -2%):

- Gap Up: NCNA +93.3%, NUVL +18.5%, ADAG +13.8%, EXAS +7.5%, CGEM +7%, ACRV +6.6%, SSYS +5.7%, MASI +5.7%, ITOS +5.4%, CACI +5%, MODV +4.8%, STRO +4.4%, DJT +3.1%, SMMT +2.9%, NUVB +2.6%, PLL +2.4%, VSAT +2.1%

- Gap Down: TIL -5.3%

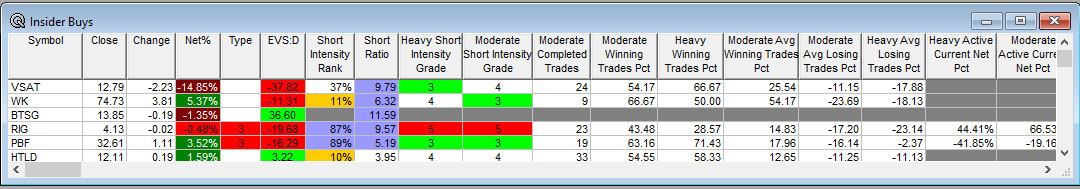

Insider Action: PBF sees Insider buying with dumb short selling. RIG sees Insider buying with smart short sellers.

Rags & Mags: Repeated stories from prior days never listed, i.e. “rehashed news”. Sorted by Global, U.S. and stock specific.

- What You Need To Know to Start Your Day. (Bloomberg)

- 5 Things To Know Before The Market Opens. (CNBC)

- Pre-Market Movers: Check back as a late release! (CNBC)

- Bloomberg Lead Story: Gunfire at Trump Golf Club is Latest Jolt in Chaotic 2024 Race. (Bloomberg)

- Markets Wrap: Fed wagers weaken the dollar and fuel more bond gains. (Bloomberg)

- Pfizer (PFE) says drug for deadly cancer condition shows positive trial data. (CNBC)

- Disney (DIS) gets top Emmy for “Shogun” for the first Emmy to them in 19 years. (Bloomberg)

- AAPL iPhone 16 first weekend pre-order analysis: estimated total sales of about 37 million units; Pro series demand lower than expected (Ming)

- Fed enters tricky terrain. Rate cuts in a decent economy. (WSJ)

- Bloomberg: The Big Take – Fed ready to unshackle US economy with soft landing at stake. (Podcast)

- Wealthion: Weekly Recap – Inflation comeback, Fed rate cut and Crypto’s future. (Podcast)

Economic:

- September NY Empire Manufacturing is due out at 8:30 a.m. EDT and is expected to fall by -4.1 from -4.7 last month.

Geopolitical:

- President Biden receives the Daily Briefing at 8:00 a.m. EDT.

- President Biden delivers remarks in Philadelphia at the HBCU (Historically Black Colleges & Universities) Week Conference at 2:30 p.m. EDT.

Federal Reserve Speakers

- Federal Reserve speakers are in blackout period this week and through next Wednesday.

M&A Activity and News:

- None of note.

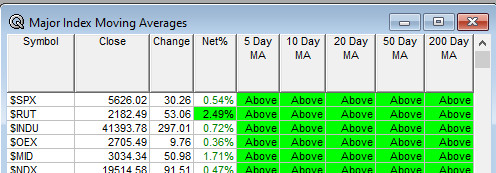

Moving Averages On Major Indexes: Moves from 80% to 100% of the moving averages being positive.

Meeting & Conferences of Note:

-

- Sellside Conferences:

- CL King & Associates Best Ideas Conference

- Northland Capital Markets

- Fireside Chat: None of note.

- Top Shareholder Meetings: ALOT, BGC, PDCO

- Investor/Analyst Day/Calls: GE, KOP, LBPH, SCHW

- Update: None of note.

- R&D Day: None of note.

- Sellside Conferences:

-

- FDA Presentation:

- ESMO Congress from Sept 13 – Sept 17

- IMTX: Data Presentation TCER® IMA401o

- JAZZ: Data Presentation Zanidatamab

- Company Event:

- Industry Meetings or Events:

- CIRSE Annual Congress

- Denver Gold Forum

- ESMO Congress

- GENEWIZ Week Event

- Insight Tech Conference

- Retina Society 57th Annual Scientific Meeting

- Pickering Energy Partners TE&M Fest

- Single Cell Genomics Conference

- FDA Presentation:

Top Tier Sell-side Upgrades & Downgrades:

The recommendations listed below in this “Upgrade/Downgrade” section are compiled from what we believe are Tier I, II and III firms. Recommendations posted are taken from a variety of sources each day and we only post upgrades or significant initiations as well as downgrades to underweight or sell. The purpose of this posting is to make the reader aware of market-moving recommendations. None of these recommendations should be interpreted as actual recommendations from CAPIS or its employees.

Upgrades: ORCL ENTG CMPX BLDR ACRV

Downgrades: WKC NSRGY CL